|

||

|

- Published: Thursday, January 30, 2020- By the A.M. Costa Rica staff and wire services The U.S. Internal Revenue Service announced on Wednesday that recent tax law changes might affect tax-exempt organizations. According to the IRS, the Taxpayer Certainty and Disaster Tax Relief Act, passed on Dec. 20, includes several provisions that may apply to tax-exempt organizations' current and previous tax years. This legislation retroactively repealed the increase in unrelated business taxable income by amounts paid or incurred for certain fringe benefits for which a deduction is not allowed, most notably qualified transportation fringes such as employer-provided parking, said the IRS. “Previously, Congress had enacted this provision as part of the Tax Cuts and Jobs Act, effective for amounts paid or incurred after Dec. 31, 2017.” The change may have impact on the many U.S. non-profit organizations, including foundations, that provide services in Costa Rica. According to the IRS, tax-exempt organizations that paid unrelated business income tax on expenses for qualified transportation fringe benefits, including employee parking, may claim a refund. To do so, they should file an amended Form 990-T within the time allowed for refunds. The legislation reduced the 2% excise tax on net investment income of private foundations to 1.39%, said the IRS. At the same time, the legislation repealed the 1% special rate that applied if the private foundation met certain distribution requirements. The changes are effective for taxable years beginning after Dec. 20, 2019, the IRS said. There also are changes that affect certain telephone and electricity cooperatives in the United States. Generally, organization must receive 85% or more of its income from members to maintain exemption. Under changes enacted as part of the Tax Cuts and Jobs Act, government grants are usually considered income and would otherwise be treated as non-member income for telephone and electric cooperatives. Under prior law, government grants were generally not treated as income, but as contributions to capital, said the IRS. “The 2019 legislation provided that certain government grants made to tax-exempt telephone or electric cooperatives for purposes of disaster relief, or for utility facilities or services, are not considered when applying the 85%-member income test,” said the IRS in its statement. “Since these government grants are excluded from the income test, exempt telephone or electric co-ops may accept these grants without the grant impacting their tax-exemption.” This legislation is retroactive to taxable years beginning after 2017. More information on this new tax law effect can be reached at IRS site. ------------------------- Have you heard changes affecting U.S. tax-exempt organizations ? We would like to know your thoughts on this story. Send your comments to news@amcostarica.com |

|

|

|

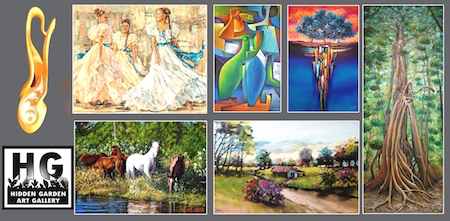

Visit the Largest Gallery in Costa Rica

Featuring

artistic expressions of Costa Rican culture, heritage

and traditions, the Hidden Garden Art Gallery has been

your source for fine art since 2010. Fifteen rooms

of art in a beautiful, tranquil setting, with more than

65 artists showcasing traditional and contemporary

paintings, sculpture, photography and giclée prints.

Located just 5 kms west of the Daniel Oduber International Airport (LIR) towards the beaches. Stop in for a visit and enjoy the view! Visit our Web site at: www.HiddenGardenArt.com Contact us by email: info@HiddenGardenArt.com |

Find us on Trip Advisor, Facebook, Twitter,

Moon Travel Guides & Frommer's

Gallery hours: Tuesdays-Saturdays, 10 a.m. to 4 p.m. C.R. phone: 8386-6872 / 2667-0592 U.S. phone: 702-953-7073 Code:9371-080618

|

|

Household

Furnishings

(paid category)

|

||

|

Fine Furniture of

Sarchi

All our

handcrafted products are made in Sarchi with

pride and quality by artisans who are dedicated

to designing, crafting, and delivering our

furniture to you.

Please visit our website and send us a picture and specifications of what YOU like, or just send us pictures from anywhere you wish. We will quote you right back with a more than competitive price and an on-time delivery date. Delivery and set up available throughout Costa Rica. We have different Costa Rican woods from which you may choose. |

Take a look www.FineFurnitureOfSarchi.com Contact information: Adolfo's Cell: +506-8831-4306 E-mail: Info@FineFurnitureOfSarchi.com or FineFurnitureOfSarchi@gmail.com Code:072019

|

|

Shipping services (paid category) |

||

|

Shipping Costa Rica Moving to Costa Rica or Back to the U.S.? » 10 Years of Happy Clients » Canadian English or Spanish Spoken » Excellent Service, Competitive Prices |

Call (772)

361-1050

Email: shippingcostarica@gmail.com Our Web: http://shippingcostarica.com Free Ebook: How To Import to Costa Rica HERE! Code:072019

|

|